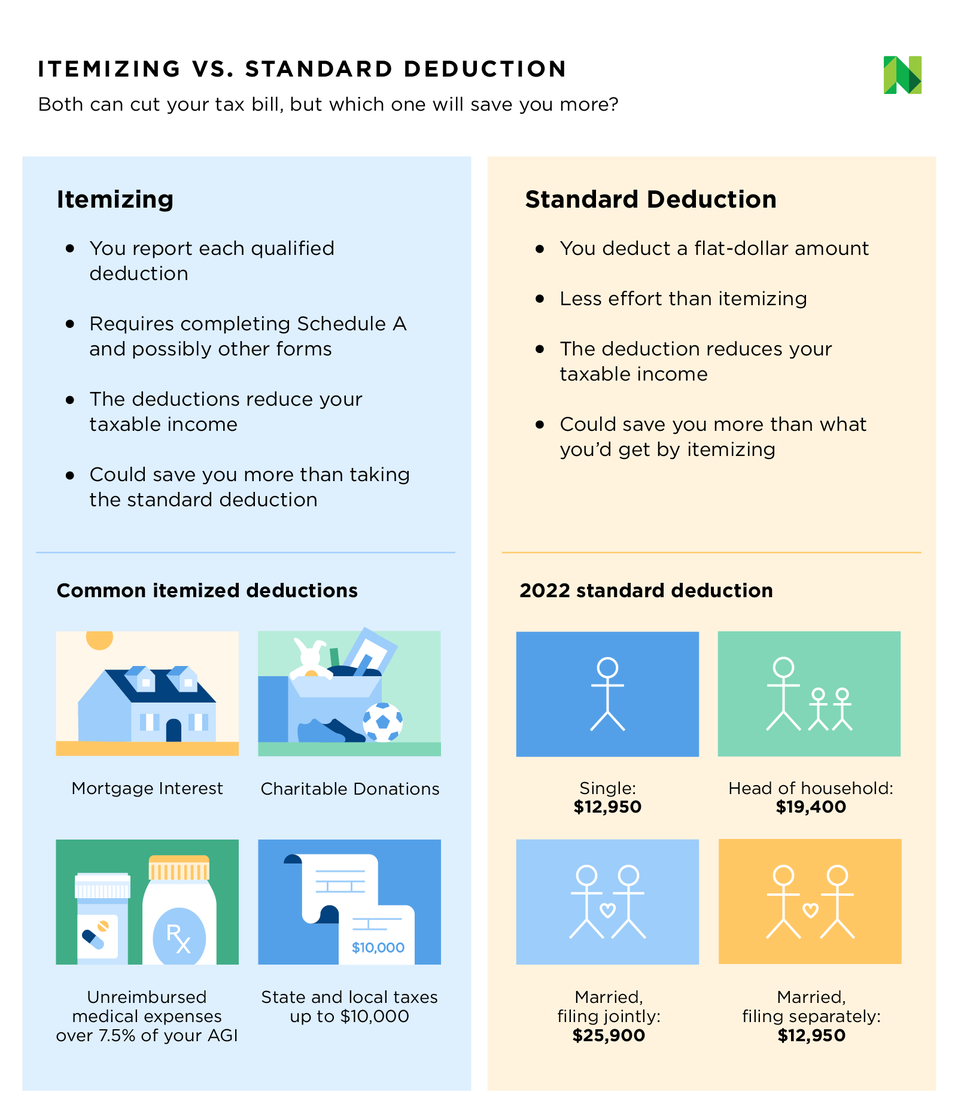

Standard Deduction 2024 Vs Itemized. Understanding itemized deductions itemized vs. If you’re allowed to itemize or take the standard deduction, calculate which would be larger.

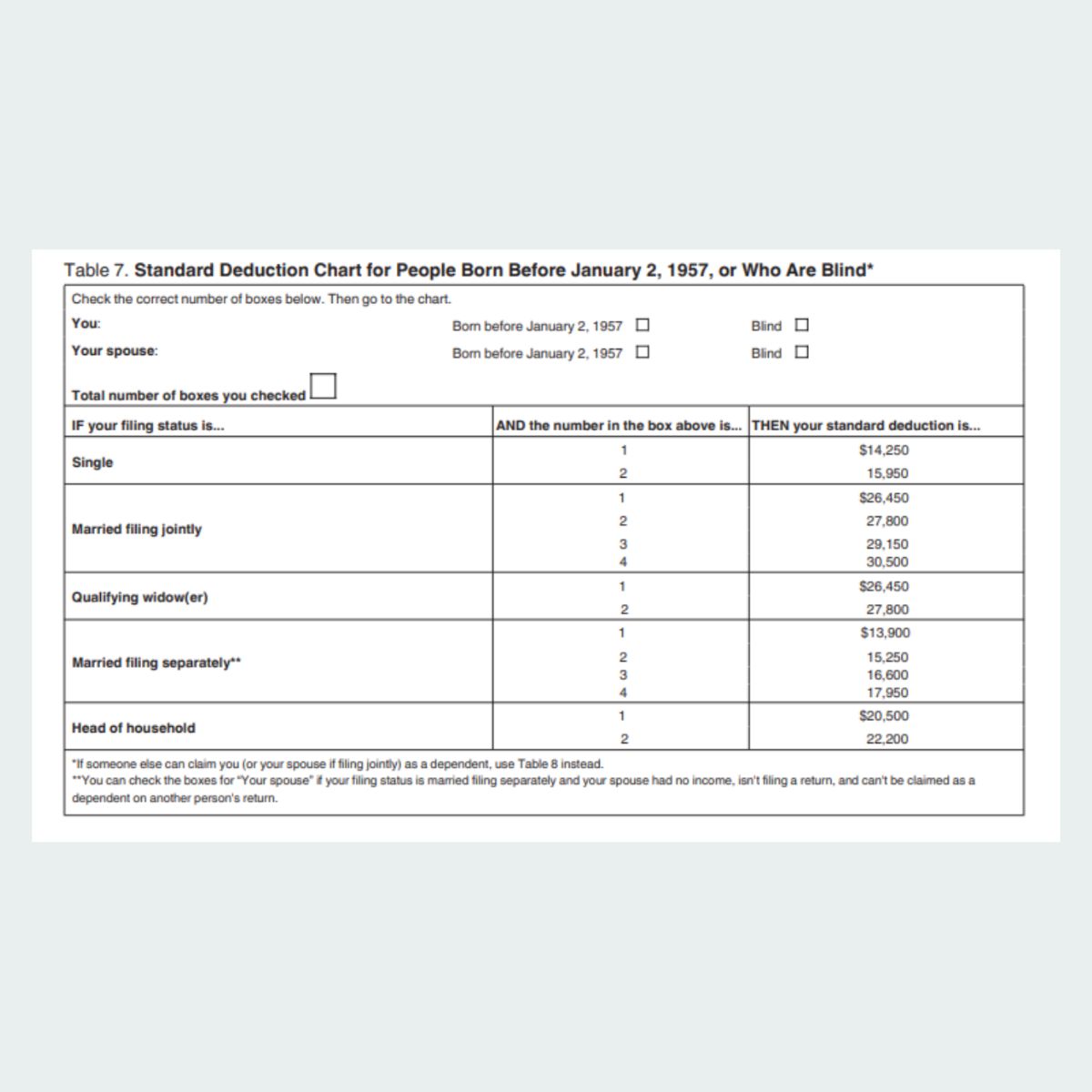

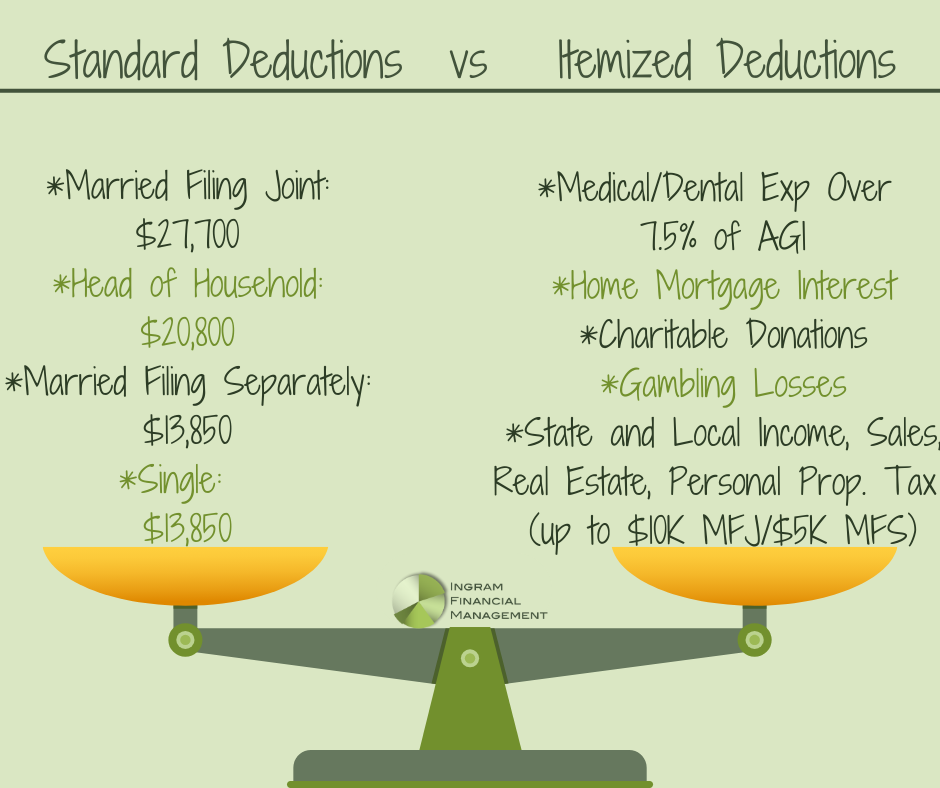

The standard deduction or itemized deductions. The standard deduction amounts will increase to $14,600 for individuals and married couples filing separately, representing an.

The Standard Deduction Is A Set Amount Based On How You File Your Taxes, With Additional Benefits For Those Who Are 65 And Older Or Visually Impaired.

For 2024, the standard deduction for single filers is $14,600.

That Might Sound Like A Lot Of Work, But It Can Pay Off If Your Total Itemized Deductions Are Higher Than The Standard Deduction.

The answer, as with most tax questions, is:

That’s A $750 Increase Over 2023.

Images References :

Source: greenbayhotelstoday.com

Source: greenbayhotelstoday.com

Itemized Deductions Definition, Who Should Itemize NerdWallet (2023), For the standard deduction, you’ll need to compare two amounts: For taxpayers who are married and filing jointly, the standard deduction for the 2024 tax year.

Source: www.youtube.com

Source: www.youtube.com

Itemized Deduction vs. Standard Deduction, Explained. YouTube, The usual 2024 standard deduction of $14,600 available to single filers, plus one additional standard deduction of. The 2023 standard deduction for tax returns filed in 2024 is $13,850 for single filers, $27,700 for joint filers or $20,800 for heads of household.

Source: quickbooks.intuit.com

Source: quickbooks.intuit.com

Small Business Expenses & Tax Deductions (2023) QuickBooks, Your guide to 2021 tax. The latest available internal revenue service data, a preliminary analysis of.

Source: www.pinterest.com

Source: www.pinterest.com

Standard Deduction vs. Itemized Tax Deduction What's Better, It accounts for otherwise deductible personal expenses such as. How much is the standard deduction for 2024?

Source: www.marca.com

Source: www.marca.com

Itemized vs Standard Deduction What are the main differences? Marca, The usual 2024 standard deduction of $14,600 available to single filers, plus one additional standard deduction of. The standard deduction is a set amount based on how you file your taxes, with additional benefits for those who are 65 and older or visually impaired.

Source: ateam.tax

Source: ateam.tax

Standard or Itemized Deduction ATEAM TAX & ACCOUNTING, The standard deduction amounts will increase to $14,600 for individuals and married couples filing separately, representing an. For 2023, the standard deduction numbers to beat.

Source: wfa-asset.com

Source: wfa-asset.com

Standard Deduction vs Itemized Deduction WFA Asset Management, The usual 2024 standard deduction of $14,600 available to single filers, plus one additional standard deduction of. For 2023, the standard deduction numbers to beat.

Source: www.ingramfinancialmanagement.com

Source: www.ingramfinancialmanagement.com

Standard vs Itemized Deductions Attiyya S. Ingram, AFC®, MQFP®, If the standard deduction is. For taxpayers who are married and filing jointly, the standard deduction for the 2024 tax year.

Source: www.pinterest.com

Source: www.pinterest.com

Itemized vs. Standard Tax Deductions Pros and Cons RamseySolutions, When it comes to reducing your taxable income, you have two options: Here are the numbers for tax year 2024:

Source: www.youtube.com

Source: www.youtube.com

Itemized Deduction vs. Optional Standard Deduction vs. 8 Tax, Compare your itemized deductions to your available standard deduction. The answer, as with most tax questions, is:

Since Congress Nearly Doubled The Standard Deduction Back In 2017, The Vast Majority Of Taxpayers (About 90%) Choose The Standard Deduction’s Set Dollar Amount.

Check the standard deduction amount for your filing status.

How Much Is The Standard Deduction For 2024?

For 2024, the standard deduction for single filers is $14,600.